|

Interest Rate Equation Conversion Formulae

This page lists Interest Rate Equations to use when converting between different Nominal and Effective Interest Rates.

INTEREST RATE CONVERSION FORMULAE

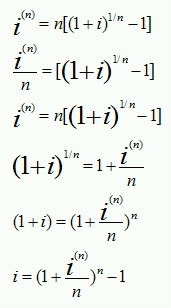

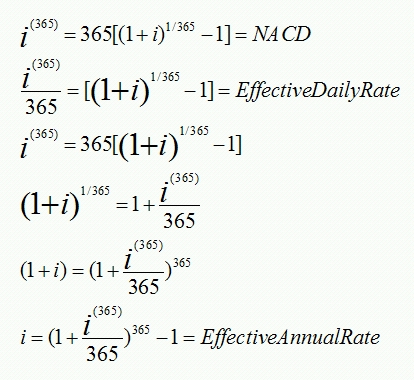

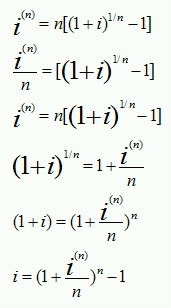

GENERAL INTEREST RATE FORMULA

i = Effective Annual Interest Rate

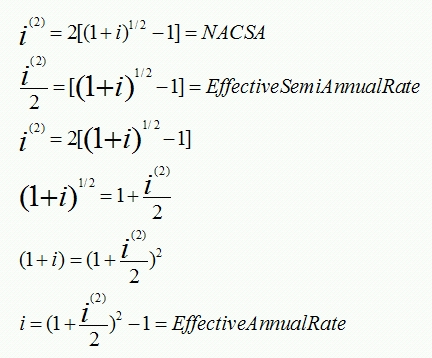

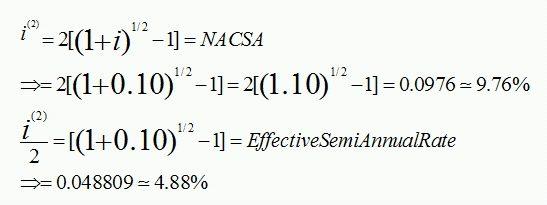

NOMINAL ANNUAL COMPOUNDED SEMI-ANNUALLY (NACSA) FORMULA

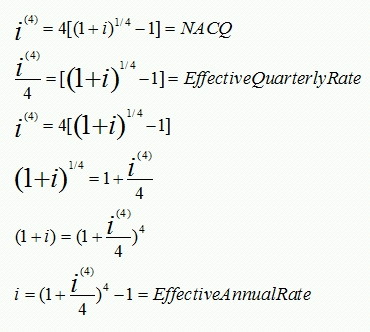

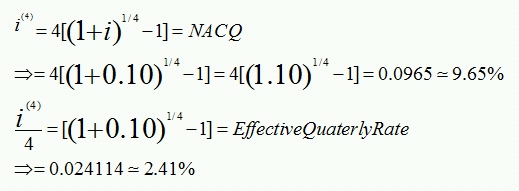

NOMINAL ANNUAL COMPOUNDED QUARTERLY (NACQ) FORMULA

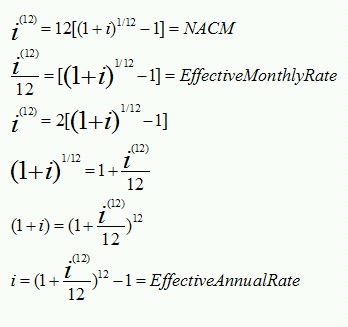

NOMINAL ANNUAL COMPOUNDED MONTHLY (NACM) FORMULA

NOMINAL ANNUAL COMPOUNDED DAILY (NACD) FORMULA

EXAMPLES: INTEREST RATE CONVERSION FORMULAE

OUR GIVEN ANNUAL EFFECTIVE RATE

For this example let's assume that we are given an Annual Effective Rate of 10% to convert to various other Nominal and Effective Rates.

So we are given:

i = 10% = 0.10

GENERAL INTEREST RATE FORMULA

NOMINAL ANNUAL COMPOUNDED SEMI-ANNUALLY (NACSA) FORMULA

NOMINAL ANNUAL COMPOUNDED QUARTERLY (NACQ) FORMULA

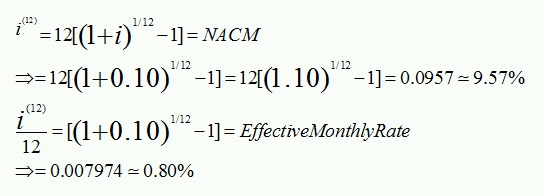

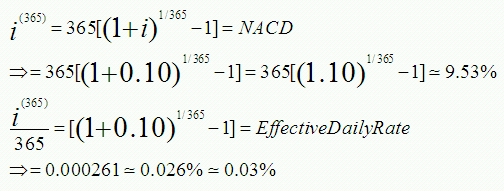

NOMINAL ANNUAL COMPOUNDED MONTHLY (NACM) FORMULA

NOMINAL ANNUAL COMPOUNDED DAILY (NACD) FORMULA

SUMMARY TABLE

| Interst Rate Type |

Abbreviation |

Symbol |

Value |

| Effective Annual Rate |

NACA |

|

10.00% |

| Nominal Annual Compounded Semi-Annually |

NACSA |

|

9.76% |

| Nominal Annual Compounded Quarterly |

NACQ |

|

9.65% |

| Nominal Annual Compounded Monthly |

NACM |

|

9.57% |

| Nominal Annual Compounded Daily |

NACD |

|

9.53% |

NOTE: As you go down the Table above the Nominal Rates decrease (i.e. as the compunding intervals increase (n becomes bigger) the nominal rates decrease).

BASIS POINTS

BASIS POINTS DEFINED

|

100 |

Basis Points |

= |

1% |

| OR |

100 |

Basis Points |

= |

0.01 |

| Therefore |

1 |

Basis Point |

= |

0.0001 |

| OR |

1 |

Basis Point |

= |

0.01% |

To express Basis Points as a percentage you simply multiply the given Basis Points by 0.0001 (= 0.01%)

EXAMPLES - BASIS POINTS

| 10 |

Basis Points |

= |

0.0010 |

= |

0.10% |

= (10*0.0001) |

| 20 |

Basis Points |

= |

0.0020 |

= |

0.20% |

= (20*0.0001) |

| 50 |

Basis Points |

= |

0.0050 |

= |

0.50% |

= (50*0.0001) |

| 100 |

Basis Points |

= |

0.0100 |

= |

1.00% |

= (100*0.0001) |

| 150 |

Basis Points |

= |

0.0150 |

= |

1.50% |

= (150*0.0001) |

| 500 |

Basis Points |

= |

0.0500 |

= |

5.00% |

= (500*0.0001) |

| 1000 |

Basis Points |

= |

0.1000 |

= |

10.00% |

= (1000*0.0001) |

| 2000 |

Basis Points |

= |

0.2000 |

= |

20.00% |

= (2000*0.0001) |

| 3000 |

Basis Points |

= |

0.3000 |

= |

30.00% |

= (3000*0.0001) |

| 5000 |

Basis Points |

= |

0.5000 |

= |

50.00% |

= (5000*0.0001) |

DESCRIPTIVE EXAMPLES

EXAMPLE 1.

The Reserve Bank has increased the official REPO rate by 50 Basis Points to 8.5%. What was the REPO rate before the increase?

SOLUTION:

Let's first express the Basis Points as a percentage

50 Basis Points = 50*0.0001 = 0.50%

So the REPO rate increased by half-a-percent

So the original REPO rate was = 8.5% - 0.5% = 8.0%

(REPO rate is the interest rate at which Central/Reserve Banks lend to Commercial Banks.)

EXAMPLE 2.

The effective discount rate on Government Bonds increased from 9.5% to 11%. By how many Basis Points did the Public Service Treasury increase the discount rate?

SOLUTION:

(a) Let's first calculate the difference between the two rates:

Difference = 11% - 9.5% = 1.500%

(b) Now let's convert this difference to Basis Points:

Percent = 1.500% = 0.0150

Basis Points = 0.0150/0.0001 (0.0150 divided by 0.0001) = 150.

So The Treasury increased the Discount Rate by 150 Basis Points.

Click here or the image below to go to the Power Station Financial Models web page for information and links to the Membership Website Sales Copy.

Corporate Finance Models

Project Finance Models

|  Interest Rate Equations

Interest Rate Equations Interest Rate Equations

Interest Rate Equations